Many people are struggling to save money and attain financial security as the cost of living rises and salaries stagnate. On a fundamental level, having money left over at the end of the month helps people deal with unforeseen bills and plan for the future. And frankly, it offers peace of mind.

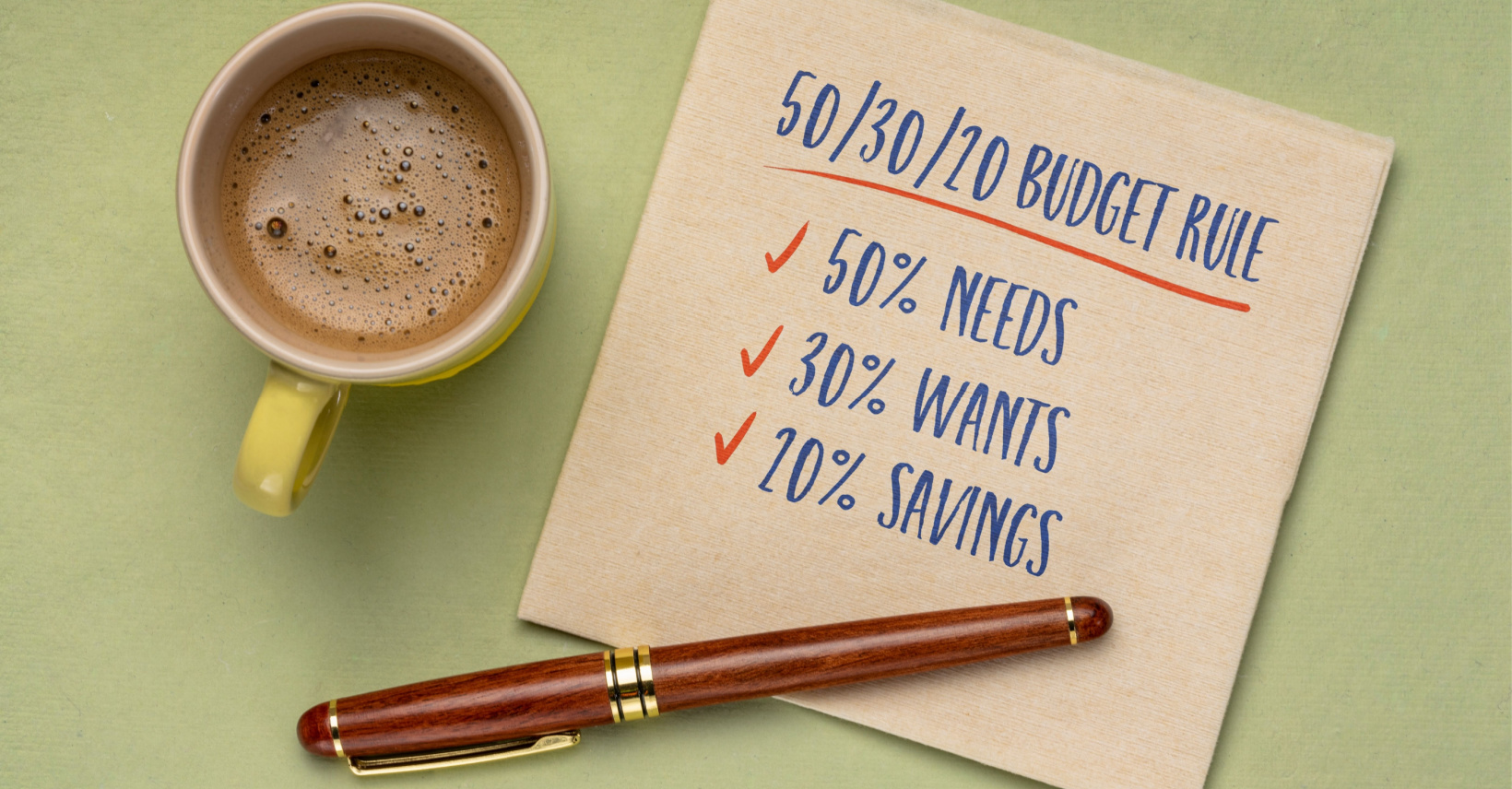

An easy way to track your spending and make financial choices is with the 50/30/20 Budget. This popular strategy can help you better manage your money and build a solid savings cushion. The 50/30/20 rule may not work for everyone, but it’s a great start to getting your spending under control and creating a realistic budget. It can also help you get a clear picture of your expenses and allow you to make financial decisions without worrying about falling behind or going further into debt.

The 50/30/20 budget rule was introduced by U.S. Senator Elizabeth Warren. She describes it in her book All Your Worth: The Ultimate Lifetime Money Plan. It was created as a basic guideline for working-class families to use when budgeting for the future and unanticipated occurrences.

The fiftytwentythirty.com website states: “This rule helps people achieve greater financial stability by spending their monthly income in three categories.” These categories include needs, wants, and savings. Here, we describe how to live on a 50/30/20 budget by each category.

How To Begin With the 50/30/20 Plan

The first step in creating a 50/30/20 budget is to know your income. This will give you an idea of how much you can spend on each category and whether you need to make any adjustments to your spending. Taking a look at your bank statements from the past few months is probably the easiest way to do this. Write down what your actual income is (after taxes). Then make a list of what you spend your money on and how much.

After you know what money is coming in and what’s going out, it’s time to figure out the financial goals you would like to set for yourself. These can include putting money toward retirement accounts, setting aside funds for a vacation, or even paying off a mortgage or other large debt.

Once you get a snapshot of your income, spending, and goals, you can make a 50/30/20 budget. The 50/30/20 rule divides your after-tax income into three categories — 50% for needs, 30% for wants, and 20% for savings and debt repayment. Let’s take a look at each category individually.

50 – Needs

Needs are those expenses you have to pay. These are your “must-have” items. They’re essential for survival but don’t include optional expenses, such as dining out, alcohol, cable TV or internet access, or shopping trips. Examples of needs include:

- Mortgage or rent

- Health care

- Utilities

- Food and nutrition

- Childcare

- Transportation

Half of your after-tax income (that’s where the “50” comes in) should be sufficient to meet your requirements and responsibilities. In other words, your needs. If you spend more than that on necessities, you will have to either cut down on a few things or alter your spending habits. Here are some ways to spend less on needs:

- Cook at home rather than eating at restaurants

- Eat for necessity rather than entertainment

- Supplement your commute with carpools or public transportation

- Reduce utility expenses by adjusting your thermostat

You should also consider whether the needs are truly necessities or if they are actually “wants.” This can be difficult, but it’s essential to keep your spending low while still meeting your basic needs.

30 – Wants

Wants are the things you enjoy, such as dining out, going on vacation, paying for a gym membership, or buying gifts and entertainment items. This includes things like HBO, Netflix, and Starbucks but doesn’t include your monthly grocery bills or the costs associated with maintaining your home. Wants are all the small things you buy to make your life more pleasurable and engaging. These things can make your life better, but they’re not essential. Here are some examples of wants:

- Cable TV

- Makeup and jewelry

- High-end hair salons

- Gym memberships

- Dining out

- Shopping

- Entertainment

- Travel

- Streaming services

- Expensive coffee shop beverages

For the 50/30/20 Budget, 30% of your income should be allocated for wants. However, if you find yourself spending more than 30% of your Budget on non-essentials, it’s time to take a hard look at your spending habits and figure out how to cut back where necessary. This can help to ensure that you’re not falling behind on your financial goals.

When it comes down to it, anything in the “wants” bucket is optional. For example, you may exercise at home instead of going to the gym, cook instead of eating out or watch sports on TV instead of purchasing game tickets.

This category also covers upgrading options such as choosing a more costly steak over a cheaper hamburger, purchasing a Mercedes over a more economical Honda, or making homemade gifts instead of giving expensive commercial items. The specifics will be unique to you and your financial situation.

20 – Savings

Any successful financial plan zeroes in on eliminating debt and building personal wealth. This will ensure that you have a secure financial future. And this is where the “20” of the 50/30/20 Budget comes in.

Savings includes any money you set aside for future goals, such as retirement contributions or a rainy day fund. You should save about 20% of your after-tax income. This includes putting money into an emergency fund in a bank savings account, contributing to a mutual fund account through an IRA, and debt-payment funds.

Your first goal in this area should be to have at least three months’ worth of emergency money on hand in case you lose your job or something unexpected happens. Following that, concentrate on retirement and other long-term financial objectives.

Debt repayment can also be included in savings. While minimal payments are considered “needs,” additional payments lower the principal and future interest payable.

Closing Thoughts on the 50-20-30 Budget

Saving money is difficult, and life frequently throws unexpected expenses our way. However, those that adhere to the 50-20-30 rule have a strategy for managing their after-tax income. For example, suppose they discover that they are spending more than 30% of their income on desires. In that case, they may identify strategies to cut those expenses and redirect money to more critical areas such as emergency reserves and retirement.

The 50/30/20 rule allows you to adjust your percentages to fit your lifestyle. For example, if you have a lower income and a higher monthly mortgage or rent payment, you can make the necessary adjustments to keep your needs spending under 50%.

This efficient budgeting approach is popular because of its simplicity, flexibility, and adaptability to various phases of life. In addition, it is based on percentages rather than earnings, so you can tailor it to your situation. As long as you have a good idea of your income and spending, the 50/30/20 budget rule can be a great asset to your financial planning.